In a typical year, we travel to client sites throughout the U.S. and Canada, talking to our clients about their most pressing challenges and celebrating their successes.

Of course, 2020 was not a typical year.

So last summer, we engaged Fernandes Health Care Insights to conduct an in-depth survey of our clients to better understand how they are using their EMPIs — and particularly, where they are headed.

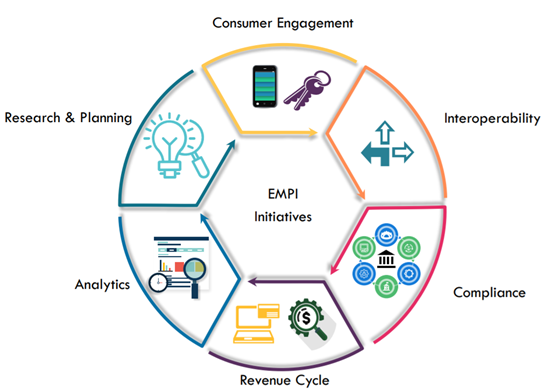

Between August and November, FHCI talked to 27 professionals in a variety of IT and business roles. And while all originally installed their IMT Master:ID EMPIs to create and manage a single view of patient records, their use has expanded dramatically with time. We observed six key initiatives that now hinge on the trusted data provided by the EMPI.

1. Consumer engagement

Nearly all our US clients are now using their EMPIs for some type of loyalty-building consumer engagement initiative. After all, consumers have more choices than ever for their healthcare, especially in more densely populated areas. That means that healthcare organizations have to prove that they truly know their consumers if they want to retain them.

Meanwhile, those consumers increasingly expect to be able to log in to a portal and schedule their own appointments, pay their (correct) bills, and get relevant alerts and wellness reminders.

Achieving that takes a single trusted data view that supports consumer preferences, especially around privacy. And that’s where the EMPI comes in.

When healthcare organizations do this well — when the data can truly be trusted — they see significant boosts to patient and caregiver confidence and satisfaction.

2. Interoperability

One client summed up a sentiment echoed by many: “Our EMPI provides trusted data that is essential to drive interoperability.”

With the EMPI at the center, clients can curate, tag, and integrate data from across a sprawling enterprise. That has become more urgent as the sheer volume of EHRs, data warehouses, and data lakes continues to grow. And with more mergers and acquisitions on the horizon, that interoperability helps clients onboard new providers while reducing costs and accelerating timelines.

See how EMPIs can overcome the interoperability shortfalls of a single-EHR strategy.

3. Compliance

We were pleased to hear how clients are using their EMPIs to navigate the ever-changing compliance landscape. Many have created automated processes that manage opt-in/opt-out preferences, and these are tailored to state- or province-specific requirements. Some teams are using these same processes to balance marketing’s data needs with HIPAA compliance and governance requirements.

Cybersecurity is a major initiative in 2021, as cyberattacks grew significantly in the second half of 2020. An IBM-Ponemon Institute study found that the average data breach costs healthcare organizations $6.5 million, or $429 per patient record — and isn’t detected for 245 days.

4. Revenue Cycle

Over the past decade, we have helped many clients expand their EMPI use beyond the clinical to support intensifying revenue cycle needs. And while some use cases are straightforward — using the EMPI to better identify patients to streamline intake and support billing — others are more advanced.

Some revenue cycle teams use the EMPI to detect fraud, while others identify uninsured patients who can be enrolled in an organization’s own plan. Still others are improving their billing processes, using the EMPI’s single trusted view to deliver a single consolidated bill to patients, or even to aggregate parent-child bills into a single statement. While cutting costs and complexity for the billing departments, these initiatives also help improve consumer engagement — and timely payments.

Some revenue cycle initiatives use the EMPI to coordinate with accountable care organizations. One client noted, “Our biggest stakeholders now are the ACOs and value-based plans; they require a single, trusted via of patient data.” And 2020 increased the urgency to participate in those value-based care programs, as those in such programs took less of a financial hit when COVID-19 disrupted “normal” operations.

5. Analytics

Everyone’s “doing” analytics, but we see a wide variety in how organizations are approaching it. Many have well-established comparative analytics programs, while others are making progress using newer cloud-based vendors for predictive analytics. The enterprise ID (EID) often serves as a linking mechanism.

Nearly all our respondents discussed plans for incorporating artificial intelligence into their work, mirroring trends reported elsewhere. COVID-19 has accelerated this trend. In fact, an Intel study found that in pre-pandemic 2020, 45% of healthcare decision makers were using or planned to use AI technologies; by late 2020, that number had skyrocketed to 84%. Another recent survey found that 95% of healthcare executives plan to hire staff with experience developing AI.

6. Research & Planning

Research teams use their organizations’ EMPIs to create a single view of patients that can be aggregated and anonymized for population health work. But beyond the bench, many planning departments are finding value, too. For example, last spring one organization faced with a PPE shortage turned to their EMPI to assess practice patterns among their providers. Others have explored contact tracing use cases to help track COVID-19 exposures among the workforce. And some use EMPI data to assess potential targets for mergers and acquisitions, aiming to understand overlap between existing patient or provider pools.

One client noted, “Nothing is out of scope of the EMPI.” We agree, and we’re excited to help our clients make progress against their 2021 initiatives. But we also want to help you overcome one of the biggest hurdles facing healthcare organizations: the Business-IT divide. See what we learned from our survey respondents in our next post.

We would love to hear your thoughts! Contact us at: sales@imt.ca